‘Product development’ at most banks focuses on developing pricing, bundling or promotion strategies based on standard industry product types that were defined eons ago by bank regulations. With everyone offering the same thing, how do you stand out from the competition?

Deposits are a good example. All banks offer the same restrictive product set described in the Federal Reserve’s Regulation D. It defines the characteristics and restrictions of four basic deposit product types: checking, savings, money market accounts, and certificates of deposits.

These products were defined by the needs and goals of regulators rather than those of customers, and most banks offer multiple versions of each of these product types. Customers are then left to figure out which of these off-the-shelf offerings will be the closest approximation to their specific needs.

Most customers can’t describe the differences between checking, savings, money market, and CD accounts – and they don’t care. All they want is a safe place to store their funds that supports their transactions and savings needs.

Working with a limited and standardized set of options, banks and credit unions try to differentiate their products by:

- Creating different versions of each product with different pricing, restrictions, and fee schedules. The thinking is that this allows customers to select the variant that offers the best value for them based on their usage patterns (but more often just creates confusion over which one they should select).

- Bundling features, which might include services such as reimbursement of foreign ATM fees, cell phone insurance, identity theft protection, or dedicated personal bankers.

- Developing relationship-based pricing structures to try to encourage additional accounts and to reward customers by maintaining higher aggregate balances.

If financial services companies were to start with a clean sheet of paper and design a series of financial products based on a deep and empathetic understanding of customer needs, it’s likely that the result would be very different from what we have today. Compounding the problem is that legacy bank and credit union core systems were designed around those legacy product types, essentially hard-coding those products in the bank’s main operating system. That makes innovation hard.

But the good news is that the migration of customer interactions to digital channels opens the door to genuine product innovation that isn’t constrained by legacy systems. Now it’s possible to develop ‘middleware’ that sits between the core system and the customer’s mobile app or web browser. This middleware can use traditional product types defined in the core system as building blocks to assemble innovative new services that are much more in tune with customer needs. Here are a few examples:

‘OneAccount’ Checking/Savings

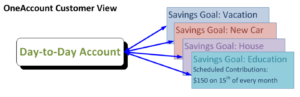

OneAccount was a working name used during the development back in 2015 of what was essentially a checking account that allowed the customer to create and track an unlimited number of specific savings goals. Here’s an illustration of the basic concept:

As far as the customer is concerned, they’ve only opened a single account with the bank that functions as a traditional checking account. But it also gives them the ability to create any number of savings goals on the fly. When creating a new goal a calculator can pop up to allow the customer to specify the amount to be saved and the time frame, and can automatically schedule periodic transfers from the core account to achieve the goal. Progress toward all the goals can easily be tracked via the bank’s mobile app or online banking system.

A product like this would be virtually impossible to implement on a legacy core system. Those systems aren’t designed to open new ‘savings’ accounts on demand, nor do they have the tools to calculate and manage contributions to each account. This problem can be solved in a digital environment, however.

In my implementation of the product, when a customer opened a new OneAccount there were actually two accounts opened in the background on the core system. Both were interest-bearing checking accounts (to avoid the Reg D transaction restrictions that used to exist). One of the accounts represented the core checking account, and the second held the total balance of all of the individual savings goals. A cloud-based middleware accounting system handled the tracking and reporting of all the savings goals that were combined in the second account. From a high-level systems perspective it looked like this:

This account was developed to simplify customers’ lives by creating simple ways for them to save for different goals – all from within their main bank account. The feedback on this product was exceptionally positive, and a streamlined prototype of the concept that we introduced in 2016 quickly exceeded our expectations in terms of attracting new deposits.

Today, you can find this same concept in use at some of the challenger banks like N26 and Monzo, along with a few other established online banks.

Ladder CD

While the OneAccount product was developed to address the savings needs of younger customers, the Ladder CD is aimed more toward older customers seeking to balance liquidity needs with the higher yields offered by certificates of deposits.

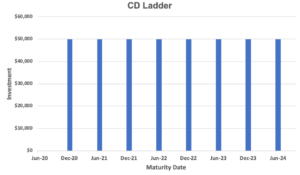

Rather than making customers create their own ladder by opening a series of individual CDs with staggered maturity dates, the concept here is to define the ladder as a single product that can be opened in one step. Customers would simply specify the total investment, maximum term, and the number of ‘rungs’ on the latter. A simple ‘4×2’ ladder, for example, would indicate that the longest maturity would be 4 years with 2 maturities in each year. In other words, this would create 8 individual CDs with terms ranging from 6 months to 4 years in 6-month increments.

Example of $400,000 invested in a ‘4×2’ CD ladder

Interactive graphical tools could allow customers to fine-tune the amounts of their total investment for each term, specify rollover options, and display the overall projected yield on the investment. After approving a single disclosure statement, the individual CDs comprising the ladder would be automatically opened on the core system – via a middleware platform much as with OneAccount.

‘Equity Maximizer’ Home Loan

Product innovation can happen on the loan side too. The Equity Maximizer product was a home equity loan product developed by the old Security Pacific Bank back in the late 1980s. It’s one that continues to be relevant today and is well-suited for use in the digital age. The idea starts with a customer being approved for an equity-secured home loan for an overall dollar amount. They can then choose how and when they draw upon that credit facility over its life.

They could treat it as a variable rate HELOC with flexible repayment terms. Or they could decide to ‘term out’ all or any portion of the outstanding balance at any point in time. Interest rates would be fixed based on the term chosen and the rates in effect at the time that piece of the outstanding balance was termed.

This product was originally designed to be serviced in a branch environment, but it was cumbersome and labor-intensive for the branch staff. Today, combining a mobile/online interface with an appropriate middleware component would allow customers to strategically manage their total credit over the life of the loan based on their changing needs. Anytime, anywhere.

This same basic concept could also be applied to unsecured personal loans, or for small business loans.

Other Ideas

The above are three illustrations of the type of innovation that is achievable by combining current technology with legacy products and core systems. What you can achieve today is really limited only by your team’s imagination.

Here are a few other ideas:

- Aggregation of accounts held at other financial institutions to create meaningful personal balance sheets and trends in your mobile app or online banking system. This information will also give you a more complete picture of the customer’s overall relationship so that you’re in a better position to offer meaningful, personalized solutions.

- Partnerships with robo-advisory firms like Betterment or Wealthfront to give customers access to transfer funds to and from easy-to-understand non-deposit investment options (with the appropriate NDI disclosures of course).

- Building off the above, you could create a personal cash management account that automatically sweeps balances over a customer-defined limit to another investment option.

- An option that would ’round up’ all purchases on an account with the funds directed to a savings goal (like BofA’s Keep the Change program), or to a charity (perhaps with a matching contribution from the bank).

- Special accounts for kids and young adults that help build financial literacy. Weekly allowance money, interest, or matching deposits could be scheduled to come from the parent’s account.

- Education savings accounts that not only schedule monthly contributions but also regularly survey college costs and update target contribution amounts based on expected entry dates and current investment returns.

Most of the above solutions are oriented around consumer accounts, but opportunities abound with business accounts as well. Particularly in the areas of small business lending, and the integration of innovative treasury management solutions.

Making it Happen

Moving forward with creative product ideas that will help your company stand out from the competition at least requires a flexible digital banking solution. If you’re using generic mobile/online banking software offered by your core banking provider, then you’re likely going to need to make some changes.

The digital banking solutions offered by the core providers are usually closed systems that restrict (or prevent) the ability to implement custom solutions. Their business model is to limit your feature choices (bill pay, P2P, PFM, etc.) to ones offered by their preferred providers. Which usually means ones owned by the core provider.

If this is where you are today, step #1 needs to be to find a new mobile/online software provider that can integrate with your core system. You’ll want to choose one that features open APIs which makes it easy to interface with third-party solutions, and you’ll want one that offers a software development kit (SDK) the supports independent development.

Ideally (and eventually!) you’d want some sort of platform banking system. One way to get there is to bring in a modern core system that is open-API by design. Another approach that many banks are taking is the ‘digital de-coupling’ route which involves creating an open-API library that rides atop your legacy core system.

Once the back-end technical obstacles are addressed, then it’s time to consider whether you have (or want to create) a development team internally to build the custom applications, or if you’d prefer to partner with a FinTech company. That decision will depend on the expertise and resources that you have available.

The FinTech partnership route is something that you should at least consider. Check out the website of the credit union consortium Constellation Digital Partners (https://www.constellation.coop) for an excellent example of what can be accomplished to drive innovation through FinTech partnerships.

The digital transformation has upended traditional business models and brought in a host of innovative, agile new competitors. Survival going forward will depend on how well banks and credit unions can tailor the products and services to the evolving needs of their customers.

Continuing to push products from the 1980s simply isn’t going to cut it. But there are tremendous opportunities to create innovative solutions with the help of readily available technology.