One comment that I hear frequently when I’m talking with banks about the need to improve customer engagement through digital channels is that “Well, our customers are different. . .” I get this most often from community banks and credit unions that have a customer base that is heavily weighted towards older demographic groups. These companies don’t see a huge need for outstanding digital services, since what their customers really want is personal service delivered through the traditional branch network.

It’s certainly true that many older customers may prefer the traditional channels that they have grown accustomed to over their lives. But not all of the bank’s customers fall in that older demographic, and not all older customers shy away from digital delivery channels. I think there can often be a perception problem on the part of bank employees. Staff perspectives on customer preferences may be influenced by a variety of factors including:

- Sample bias. Branch personnel only see and talk with those customers who choose to come into the branch. They don’t see the ones that are interacting primarily or exclusively through digital channels. I ran an analysis for a bank a few years ago that had a customer base with a median age of 54. The results showed that over one-third of their customers who had a checking account had not visited any branch in the past year. Since this ‘digital-only’ group was not interacting with the bank through traditional channels, their needs were not well understood and the size of this cohort was not readily visible.

- Lack of choice. Customers may continue to come into a branch simply because the bank does not offer them other options to get their needs addressed. Many banks still do not have systems in place that will support the opening of a new deposit account completely online. Or apply for a loan. Or transfer funds to another financial institution. While customers may prefer the convenience of completing activities like these online, the bank forces them to come into a physical office through their lack of investment in digital channels.

- Lack of knowledge. A Fiserv survey released a year or so ago revealed that many customers do not use digital channels simply because no one ever showed them how! No one ever taught them how to set up Bill Pay, or deposit a check using the bank’s mobile app, or initiate a peer-to-peer payment. How many of these people would embrace the convenience of anywhere, anytime banking if someone had only shown them how?

- Defense of the status quo. Long-term bank employees often tend to cling to a branch-centric view of the world that has been their reality throughout their careers. They may say that their customers prefer the branch experience, but what they really mean is that they fail to see how the business could be successful any other way. They may also fear for their jobs should digital adoption accelerate.

- The branch is our sales platform. Related to the above, many traditional banks rely heavily on their branch network for sales of products and services and the acquisition of new customers. They lack the marketing and customer engagement practices needed to grow the company through digital channels. Which means they need customers to come to the branch. It becomes easier to rationalize this situation if they choose to believe that customers prefer the branch experience.

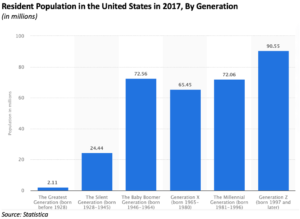

Looking beyond what the preferences of the current customer base may be, serious consideration must be given to the needs of the new customers that the bank must continue to attract in order to grow and thrive. Different generations may have different service preferences, with the younger ones having a decidedly greater affinity for digital services that they can access via their mobile devices based on their needs and schedules. The chart below shows the size of the various generations as of 2018:

Banks that cater primarily to Baby Boomer and older customers need to realize that this group only makes up 30% of the total market today, and is steadily shrinking. The future of any company will depend on its ability to attract younger customers.

With these points in mind, community financial institutions may wish to research the needs and engagement preferences of their current customer base using behavior patterns gleaned from analyses of transactions data and customer demographic information, supplemented perhaps with surveys and focus groups. This could then be followed by research into the needs/preferences of desirable customer segments that are under-represented in the bank’s current customer mix. Armed with this information, bank management will be in a much better position to assess the investments in technology they need to make in order to attract and retain the customers needed to achieve long term growth goals.

This type of fact-based analysis will likely prove more useful than relying on anecdotal perceptions.