Articles

A Banker’s Toolkit: 5 AI Projects to Get You Started

Not sure where to begin with AI? This guide lays out five practical projects—ranging from internal chatbots to cross-sell engines—that any bank can start exploring today. No massive budget or data science team required. Just smart steps toward better efficiency, insight, and customer service.

“So … Are We Doing Anything With AI?”

Many bank board members are asking: “Should we be doing something with AI?” The answer is yes—and if management hasn’t brought it up, that’s a red flag. This guide helps directors understand where AI fits in banking, what risks to watch for, and what smart oversight looks like—no tech background required.

Business Intelligence for Community Banks – An Agile Guide

Many community banks are data-rich but insight-poor. This post explores how an agile, phased approach to business intelligence can help banks unlock meaningful insights quickly—without massive investments or long timelines.

The Payments Puzzle: Smart Moves for Community Banks

Community banks are feeling the pressure to modernize payments—but limited vendor options, high costs, and fraud concerns make the path forward unclear. Let's unpack those challenges and discuss strategies for staying competitive.

Why Mindset Matters —Especially for Your Company

Mindset isn’t just a personal trait—it’s a business strategy. Companies with a growth mindset adapt faster, innovate more, and invest in people. Learn how to spot fixed-mindset traps and take practical steps to build a culture of continuous learning and growth.

What Smart Acquirers Do Before Legal Close

Mergers move fast—and if you don’t get the right data early, you risk flying blind. This post explains why smart acquirers push for structured data extracts before legal close, what information to ask for, and how to do it responsibly. From product planning to fair value adjustments, the payoff is huge.

“I Managers” vs. “We Managers”

Too many companies stall out not because of poor strategy, but because the wrong people are leading key teams. This post helps CEOs distinguish between two powerful leadership styles—“I Managers” and “We Managers”—and shows how each one impacts culture, innovation, and long-term growth.

Helping “I Managers” Grow

Some managers drive performance. Others quietly drain team morale. If you're serious about building a strong leadership bench, it’s time to identify the “I Managers” in your company and help them grow into team-first leaders. This post walks through how to spot the signs, understand the root causes, and guide those managers toward more collaborative, effective leadership.

The Physics of Business Decision-Making

Why do once-thriving companies like Kodak, Blockbuster, and Toys "R" Us fail to adapt to changing markets—while others like Amazon and Netflix reinvent themselves? This post explores how Newton’s laws of motion offer a surprisingly useful lens for understanding business inertia, transformation, and the consequences of action (or inaction). Learn how applying these principles metaphorically can help leaders make smarter, more adaptive decisions.

Strategic Plan Scorecard

Too many financial institutions confuse a wish list of vague initiatives with actual strategy. This post offers a practical scorecard to help bank executives and board members evaluate—and improve—their strategic plans. From business models and technology to marketing and culture, it provides 58 focused questions across critical planning categories to ensure your plan is realistic, forward-looking, and actionable.

How to Create an Innovation Culture

In a world of constant change, companies can’t afford to cling to the status quo. This post explores why innovation isn’t just a buzzword—it’s a survival strategy. Learn how to shift your corporate culture to encourage creativity, risk-taking, and continuous improvement, and discover nine practical strategies to foster a more innovative, resilient organization.

Lessons Learned from a Digital Banking Conversion

After completing a major mobile and online banking system conversion for a multi-billion-dollar credit union, we took a hard look at what worked and what didn’t. From project planning and testing to customer communications and post-launch support, this post shares detailed lessons learned—along with practical tips for financial institutions preparing for their own system conversions.

5 Things To Consider As You Complete Your Strategic Plan

As annual planning season wraps up, now’s the time to take a step back and make sure your strategic plan hits the mark. Is it focused on customer needs or internal processes? Does it define a clear future vision and allocate resources wisely? This post offers a checklist to ensure your plan drives real strategic progress—not just paperwork.

You Need Actionable Data to Survive

Data is the key to smarter decisions, better customer experiences, and long-term growth. But many banks still struggle with fragmented, hard-to-access information. This post breaks down the core benefits of a modern data warehouse—from integrating siloed systems and improving efficiency to enabling advanced analytics and supporting real-time business intelligence. If your institution hasn’t made data a strategic asset yet, now is the time.

The Importance of a Strategic Budget

Operational budgets keep the lights on. Strategic budgets move the company forward. This post explores the key differences between the two—and explains why carving out a dedicated budget for long-term, cross-functional initiatives can help financial institutions stay focused, fund innovation, and actually deliver on their strategic plans.

Competing with Marketplace Lenders

Marketplace lenders are winning not on price, but on speed and simplicity. Many banks are responding with small tweaks and marginal improvements—but that won’t be enough. This post challenges financial institutions to rethink their back-office processes and customer experience from the ground up if they want to stay competitive in a digital-first lending landscape.

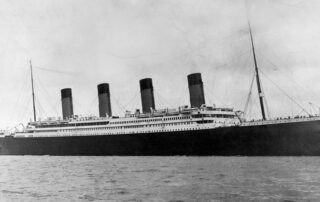

Musicians on the Titanic

Strong earnings reports and dividend payouts may calm investors—but they won’t future-proof your bank. In this post, a haunting historical analogy highlights the danger of complacency in today’s banking environment. Legacy systems, rising customer expectations, and fintech disruption are accelerating change. Now is the time to act decisively—or risk being left behind.

The Challenge of Long-term Employees

Veteran employees bring deep knowledge and loyalty—but can also resist the very changes your company needs to survive. This post explores the double-edged sword of workforce longevity, and offers practical strategies for engaging long-tenured staff while building a culture that embraces innovation and transformation.

Survival of the Fittest

Charles Darwin’s principle of survival through adaptation applies just as much to businesses as it does to biology. This post explores how digital transformation has gone from a competitive edge to a survival requirement in banking. From the long arc of technological change to the sudden jolt of the pandemic, the message is clear: banks that fail to change may not be around for the next cycle.

COVID-19 Shredded Bank & Credit Union Plans. Here’s How To Reboot

COVID-19 disrupted every assumption banks made at the start of the year. Now is the time to pause, reflect, and reset. This post outlines a practical, three-step framework for reviewing your pandemic response, understanding how the world has changed, and redefining priorities for the months ahead—so your institution can emerge stronger, smarter, and more resilient.

Creating Innovative Products with Technology

Most bank products were shaped decades ago by regulation, not customer needs. But today’s digital capabilities make real innovation possible—without replacing the core system. This post explores how forward-thinking banks and credit unions can use middleware, open APIs, and customer-centric design to create truly differentiated offerings that stand out in a sea of sameness.

You Still Have a Chance to be a Player in the Personalization Game

Customers today expect personalized service—even from their bank. But despite massive investments in AI and digital platforms, even the biggest players like Bank of America sometimes miss the mark. This post explores how smaller institutions can build simple, effective customer analytics capabilities to deliver relevant, timely communications—and compete with the giants on value, not volume.

ROI on Digital Transformation Investments

When evaluating digital banking projects, many institutions get stuck asking, “What’s the ROI?” But the reality is, transformative investments often defy traditional financial modeling. This post explores why standard ROI frameworks fall short—and offers a smarter approach to prioritizing digital initiatives that are essential to long-term survival.

But Our Customers are Different . . .

Many community banks believe their older customer base isn’t interested in digital channels. But this assumption often stems from anecdotal perceptions—not actual data. In this post, we explore why a branch-centric mindset may be blinding institutions to growing digital demand, and how banks can use behavioral data to better understand customer needs and plan for future growth.

Do Business Banks Need to Worry About Digital Transformation?

Many business banks believe they’re insulated from digital disruption—but that’s a dangerous illusion. From rising funding costs and inefficient legacy processes to inadequate tech stacks and FinTech competition, strategic risks are growing. This post explores why a “wait and see” mindset puts business banks at risk—and what leaders can do to start transforming now.

Design Thinking – A Different Approach to Decision Making

Design thinking is a customer-first, iterative approach to solving business problems—especially those tied to digital transformation. Unlike traditional decision-making, it begins with empathy, invites experimentation, and reduces the risk of failure by testing ideas before full-scale rollout. Here’s how it compares to conventional project planning—and why more financial institutions should take note.

Digital Transformation and the Board of Directors

Too many bank boards still reflect a bygone era—older, male, and lacking in diversity. That might have worked in the past, but today’s fast-changing world demands leadership that mirrors the communities it serves. In this post, I explore how board composition affects digital innovation, customer engagement, and long-term relevance—and offer practical steps to build a more representative and forward-thinking board.

Digital Transformation: Is It Worth It?

After a recent board presentation, a community bank CEO asked me a tough but important question: Can we really catch up? In this post, I explore how bank leaders should weigh the decision to invest in transformation—or consider strategic alternatives if the challenges seem too great. For many, survival is possible—but only with bold leadership and a clear vision.