Data is the lifeblood of a company in the 21st century. It’s essential for understanding customer behavior and anticipating their needs. It can improve operational performance, identify opportunities, and help manage risks. Yet many financial institutions struggle to easily assemble a complete and reliable view of their operations across core applications, siloed department data sources and third-party systems.

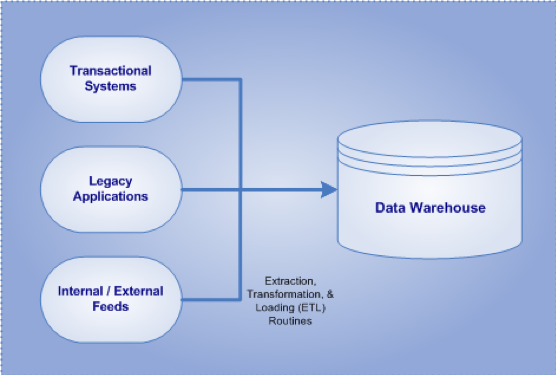

A data warehouse solves this problem by creating a centralized repository that pulls current and historical data from all relevant internal and external data applications. It is designed and optimized for decision-support, analytical reporting, ad-hoc queries, and data mining. The data warehouse also provides a storage environment that is separate from any of the operational systems. This isolation enables querying without any impact on the systems that support day-to-day operations.

The following is a summary of some of the key benefits of data warehouses:

- Integrates data and enhances quality & consistency

Bank information systems include core system modules, data residing on third-party platforms, and information stored in departmental-specific software applications. Getting the information needed to manage the company involves merging data from many disparate data sources to get a complete picture of bank operations and customer activities.

To solve this problem, the data warehouse consolidates enterprise data into a single data repository with standardized formats and definitions. This alleviates the burden of duplicating data gathering efforts across the organization. It also enables the extraction of information that would otherwise be difficult or impossible to obtain. This gives decision-makers and business users instant access to validated information from across the company. This data warehouse becomes the “single source of truth” for the enterprise, with all users pulling their information from the single source.

To solve this problem, the data warehouse consolidates enterprise data into a single data repository with standardized formats and definitions. This alleviates the burden of duplicating data gathering efforts across the organization. It also enables the extraction of information that would otherwise be difficult or impossible to obtain. This gives decision-makers and business users instant access to validated information from across the company. This data warehouse becomes the “single source of truth” for the enterprise, with all users pulling their information from the single source.

- Ability to import data from other sources

A data warehouse can bring in data from a myriad of other sources that add useful insights for internal analysis, including demographic data, economic data, etc. This information can then be integrated with data from traditional financial applications to enhance analyses and reporting.

- Improves productivity & efficiency

It’s very time-consuming for a business user or analyst to have to gather data from different sources. Often that also involves using different data extraction tools and then combining the results in other software such as an Excel workbook for analysis and reporting.

It’s much better to have data automatically gathered in a central data warehouse with consistent formatting and definitions, where it can be validated and accessed. This can also permit users to access the information without needing support from the IT department.

Data warehouses are also designed and constructed for the storage of large volumes of data, with a focus on the speed of data retrieval and analysis. A data warehouse makes it very easy to perform complex data aggregations and analyses, both within specific time periods and across time.

- Improves financial performance

A data warehouse facilitates digging deep into the organization to derive actionable insights from data and trends. It can generate tangible financial benefits in a variety of ways, including:

-

- Radically reducing staff time spent gathering data and preparing reports. This allows more time for designing and implementing solutions, as opposed to spending hours pulling together information to try to understand the problem.

- Increasing customer engagement, satisfaction, retention and profitability through gaining a better understanding of their needs and identifying relevant solutions.

- Providing a source for the development of metrics to measure, monitor and reward performance across the company.

- Identifying business risks to support the development of appropriate mitigation strategies.

A data warehouse is also the foundation supporting business intelligence insights. Business intelligence focuses on supporting fact-based decision-making, which improves outcomes by allowing managers and executives to base decisions on something other than ‘gut feel’. Decisions that affect the strategy and performance of the company are then based upon credible facts backed up with evidence and actual organizational data.

- Provides historical intelligence

Having a rich and readily accessible store of a large amount of historical data allows easy analysis of past trends. Data elements are stored in a way that allows makes trend analyses over past time periods extremely straightforward – something that many querying tools designed for legacy reporting systems cannot do.

- Communicate information more effectively

Having good reporting and visualization tools is essential for the exploration and analysis of data, as well as for communicating results to end-users. Data warehouses can facilitate the creation of robust reports and dashboards to display information pulled from different sources in easy-to-understand charts, graphs, and tables. These dashboards can be customized to the needs /roles of individual users.

- Cloud-based solutions offer scalability

Most data warehouses are now at least partially (if not fully) cloud-based. Cloud-based servers are highly cost-effective, avoiding the need for in-house teams to maintain server infrastructure. The cloud architecture also allows the data warehouse to easily scale as the organization and its needs grow.

- Provides support for advanced analytics

Developing and deploying machine learning (ML) algorithms is becoming more and more important to remain competitive in the financial services industry. The historical information contained in a data warehouse can be used to develop these models. Use cases for ML are varied and continually growing. They encompass areas such as customer service, process automation, personalized customer engagement & cross sales strategies, risk management & cyber-security, and portfolio management.

A data warehouse can also supply information to other internal applications such as CRM, along with risk models such as ALM, CECL, and DFAST.

- Improved data security

Data security is always a major concern for financial institutions, and this applies equally to the information stored on-premises as well as cloud-based solutions. More institutions are migrating to cloud-based solutions which have many enhanced security features. Some of the benefits of cloud storage include:- Redundancy – data can be stored and backed up across multiple regions

- Strong user access controls

- Encrypted data transfers

Getting There

Data warehouses can add so much value to an organization in today’s hyper-competitive world that they have become more of a necessity than a luxury. Your legacy core system may claim to have an integrated ‘data warehouse’, but it rarely (if ever) provides the level of sophistication necessary to develop and report insights needed to run the company.

Creating a new data warehouse – or enhancing an existing one – is not that difficult a task given today’s technologies. Here are a few best practices to consider:

- Use Agile development practices. Don’t try to create the ‘perfect’ data warehouse from the beginning. Instead, start with pulling the key data items needed to address the most common needs. The goal is to get meaningful and timely results in the hands of users and decision-makers as quickly as possible. This will not only begin to prove the value of the system but also serves as a starting point for mapping out future, iterative enhancements. It’s easy to add elements and data feeds to the database later on.

- Use a cloud-based software platform such as Snowflake, Amazon Web Services, Google Cloud, or Microsoft Azure. Be careful when looking at proprietary data warehouse solutions, as they may have limited functionality or lack the ability to customize the system to your company’s evolving needs.

- Use an industry-tested data warehouse schema to start with. There’s no need to reinvent the wheel on this, and you can always expand on it later.

- Build-in strong data governance standards from the start. The keys are data availability, usability, integrity, and security. And make sure everything is well-documented!

- Get the help you need. Many companies may lack the expertise in-house to tackle a project such as this so look to outside resources to assist. Be sure to also assign internal people to work on the project to both ensure knowledge transfer and up-skill your employees. And insist on continuously-delivered documentation and frequent status updates.

- You may want to feed in data from flat file extracts to start. Once everything is tested and validated, you can begin to build out the ETL (Extract, Transform, Load) automation.

- As you start, it’s helpful to create a comprehensive inventory of current reporting processes across the organization. This list will help prioritize the migration to automated reporting from the data warehouse. This is a good way to further demonstrate the value of the project in terms of potential staff hours saved.

If your company isn’t currently taking full advantage of data warehouse technology, it’s time to seriously consider making it a strategic priority.